Your Family’s Tax Savings, Built to Last

Maximize your family’s financial future with expert tax planning strategies. Learn how to legally hire your children, reduce your taxes, and invest in their education, skills, and future wealth — all while keeping full IRS compliance.

We Focus & Specialize in

Family Tax Planning

We focused exclusively on helping parents with small businesses, we guide you to legally hire your children, maximize tax savings, and invest in their education and future wealth

Your Family’s Tax Advocate

We make sure every dollar you earn works for both your business and your kids’ future.

Transform Your Career Path with Our Proven Solutions

Unlock your potential with expert guidance and tailored strategies designed to elevate your career, accelerate your growth, and achieve your professional goals.

Best Career Coaching Award

3x Winner — Best Career Advisor

Over 4000+ Happy Clients...

4.9 star | 11k+ ratings

How it Works

Book a private session with our IRS Enrolled Agent to review your business setup, answer your questions, and pinpoint the tax strategies or financial plan that will work best for your family.

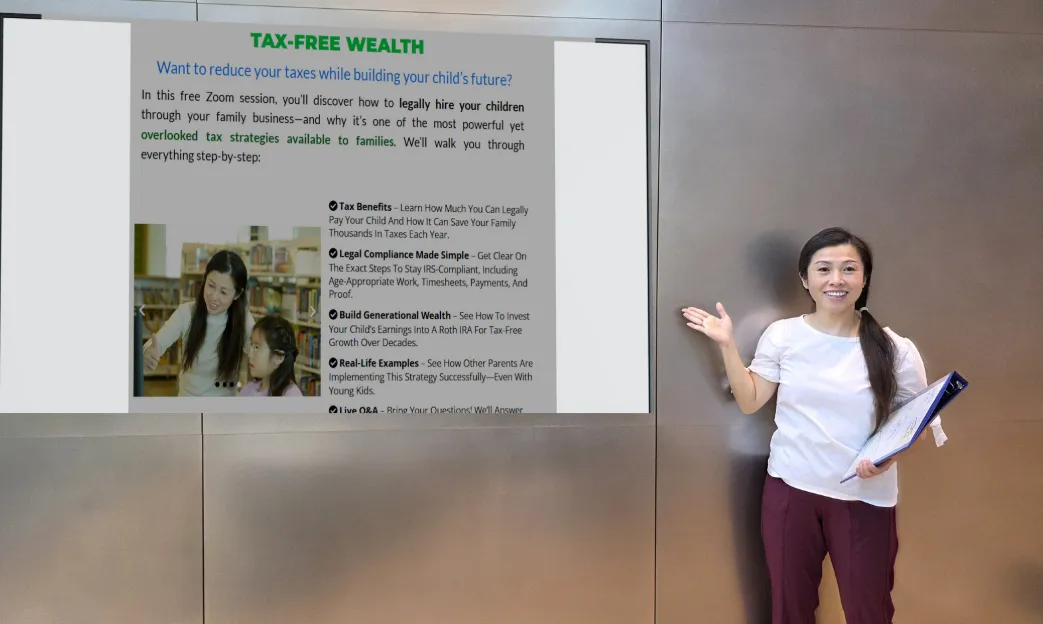

Register to Receive a Recorded Webinar

Get instant access to our step-by-step training on legally hiring your children, maximizing tax deductions, and staying fully compliant with IRS rules — all at your own pace. This is the most powerful tax strategies for parents with family business.

Sign Up to Attend a Live Zoom Session

Join our interactive group meeting where we walk you through real-life examples, answer your questions in real time, and help you see exactly how to apply these tax strategies for your own family.

Smart Strategies to Keep More of What You Earn

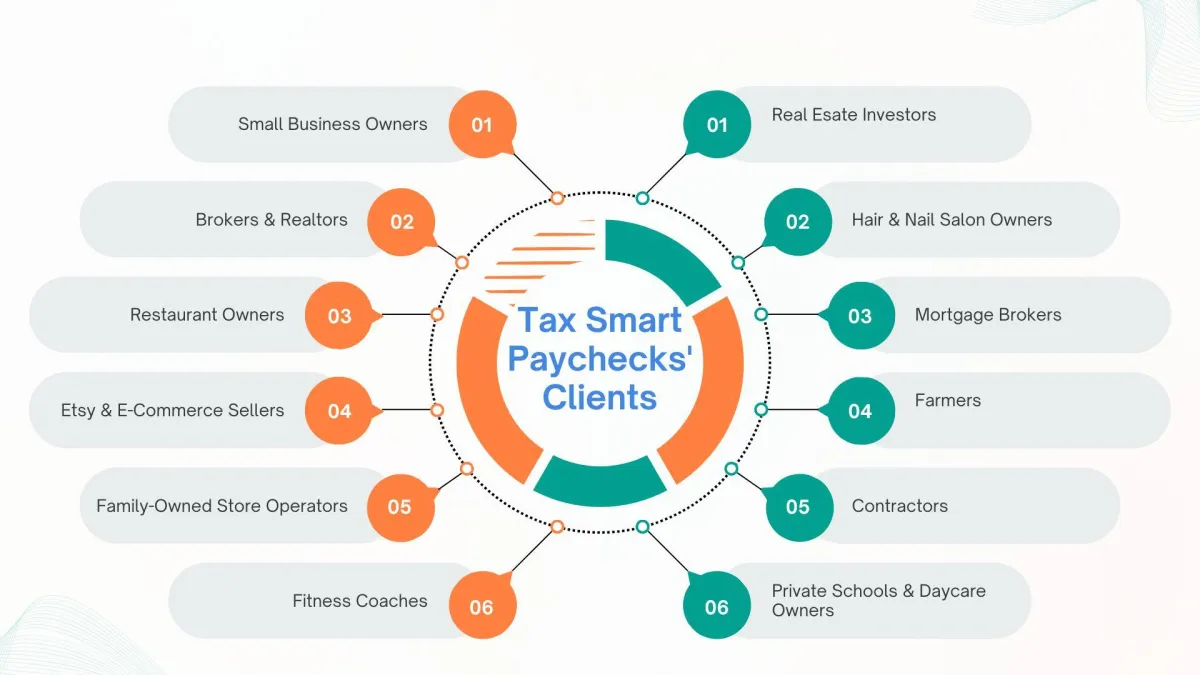

At TaxSmart Paychecks, we help family-owned businesses go beyond just one tax strategy. While the Hire Your Child System (HYCS) is one of our most popular solutions, we also provide a full range of tax planning tools to fit your unique situation.

You’ll discover how to:

Legally hire your children and deduct their wages

Use retirement plans (like Solo 401(k) and SEP IRA) to reduce taxable income

Maximize deductions for home office, vehicles, and business travel

Structure your business for long-term tax efficiency and asset protection

Integrate education savings, Roth IRAs, and inheritance planning

With expert guidance from the first IRS Enrolled Agent specializing in parents with small businesses, you’ll have the clarity, strategies, and ongoing support to lower taxes and build your family’s financial future.

What are Reasons that Our Clients Chose and Continue to Choose Us?

Real Financial Impact and Long-Term Value

This isn’t just about saving on taxes for one year. It’s about creating a repeatable, legal strategy that builds your children’s skills, increases their future wealth, and strengthens your family’s finances over the long term. Our clients return because they see the results — both in their bank accounts and in their kids’ growth.

Get immediate solutions to your challenges

through personalized coaching that addresses your unique career needs.

No more waiting for answers—take action now.

Proven, Step-by-Step System with Ongoing Support

We cut through the noise. Our program helps you gain clear direction, prioritize what matters, and create a step-by-step plan tailored to your career goals—so you stop feeling stuck and start moving forward.

Specialized Expertise You Can’t Find Anywhere Else

We are U.S. tax experts specializing exclusively in helping parents with small businesses maximize deductions, stay fully IRS-compliant, and integrate financial planning with consistent execution. Our clients trust us because we understand the intersection of tax law, long-term growth, and the unique dynamics of running a family business.

Features Included

Transform your family’s finances with our comprehensive programs — combining proven tax strategies, personalized coaching, and consistent support to help you legally lower taxes, build long-term wealth, and stay fully IRS-compliant.

Here’s everything we offer to our clients.

Custom Tax Planning Roadmap – A tailored plan for your business and family situation

Additional Tax Strategies – Home office, vehicle, travel deductions, retirement plans

Optimized Retirement Planning – Solo 401(k), SEP IRA, and other tax-advantaged plans

Optimized Entity Structure – Set up your business to unlock the highest legal tax benefits

One-on-One Strategy Sessions – Private calls with a Tax Expert / Tax Planner / Financial Planner.

Complete Tax Strategies Implementation Guide – Step-by-step & Checklists & Resources

Work-Life Balance Strategies

Live Weekly Meetings for Parents – Get direct coaching, updates, and Q&A in a group setting

Recordkeeping & Compliance Tools – Templates to pass any IRS audit with confidence

Weekly Text Reminders for Plan Execution – Stay on track and never miss a step

Work Ethic & Time Management Training – Instill discipline and productivity

Lifetime Access to Training Resources – Always stay updated with the latest strategies

Real-Time Q&A Support – Get answers to your questions as they come up

Satisfaction Guarantee

Children Transition Assistance

Skills Development Workshops for Kids

Live Weekly Training for Kids – Age-appropriate skill and work training to help them succeed in family business

Lifetime Access to Training Resources – Always stay updated with the latest strategies

Age-Appropriate Leadership Development for Kids

Financial Education for Kids – Build your children’s money skills alongside tax savings

Postive Peer Influencing Environment Education – foster healthy social connections, and encourage positive peer influence, so they grow in both skills and character

Cash Flow Management & Profit Allocation – Ensure income supports both business growth and personal goals.

Education Funding Strategies – 529 plans, Coverdell accounts, and hybrid approaches.

Wealth Transfer & Legacy Planning – Pass on assets efficiently and tax-effectively.

Asset Protection Planning – Use entity structures and insurance to safeguard wealth.

Recordkeeping & Documentation Tools – Pass any IRS audit with confidence.

IRS-Compliant Contracts & Documents

Payroll Setup & Tax Form Filing Support – Step-by-step assistance for accuracy.

Weekly Text Reminders for Execution – Stay on track and never miss a step

Live Weekly Meetings for Parents – Get direct coaching, updates, and Q&A in a group setting

Teamwork & Problem-Solving Workshops – Strengthen communication and collaboration skills.

Work Ethic & Time Management Training – Instill discipline and productivity.

Role & Responsibility Assignments – Structured tasks to build accountability.

Leadership Development for Kids

Financial Education for Kids – Build your children’s money skills alongside tax savings

Hear How We Are Hepling Our Clients

Our clients’ success stories speak volumes about the impact of implementing Tax-Smart Paycheck tax strategies.

Huong Dam - Salon Owner,

Baytown, TX

I thought tax planning was just for big companies. This program walked me through step-by-step, even helping me set up payroll and track my kids’ work so I’d be 100% IRS-compliant. Now my 12-year-old is learning graphic design and earning for his Roth IRA.

Dung Le - E-commerce Store Owner

Houston, TX

We’ve always wanted our kids to learn about money early. This gave us a legal way to pay them for helping with inventory and shipping in our store. The tax savings basically covered our summer family vacation. Now my 12-year-old has her bank account and a Roth IRA started before most kids even know what those are.

Abigail Thach - Restaurant Owner

Austin, TX

Before meeting Cara Phan, I didn’t even know hiring my kids was an option. Now my 13-year-old and 15-year-old help with social media & digital marketing for our business. I’m saving over $5,500 a year in taxes. It feels good.

Thinh Hoang - Farmer

Lubbock, TX

The weekly parent reminders keep me on track. Even when I’m busy running my business, those sessions remind me of the next steps so I never fall behind on compliance or recordkeeping. Thank you. It is so thoughtful of you to set this up.

Jennifer Tran - Real Estate Investor

Austin, TX

My 14-year-old used to avoid chores and responsibilities. Now, through the kid-focused training, he’s on time for his tasks, logs his work hours properly, and even reminds me about project deadlines. My 9-year-old daughter joined the live kids’ workshops, and I can see her remember and think of her assignments more. She’s surrounded by other kids who take responsibility seriously, and it’s rubbing off on her.

May Vuong - Home Daycare Owner

Austin, TX

The audit templates are a lifesaver. I know exactly what records to keep, and everything is organized for IRS compliance. The text reminders keep me accountable. I actually follow through instead of forgetting until the last minute. I appreciate the system Cara Phan puts her time, expertise and passion in it.

Sarah Luong - Realtor

Lubbock, TX

My kids each opened a Roth IRA with their earnings. At 14 and 16, they’re learning more about money than I did in my 20s. I was hesitant at first, but the guarantee gave me peace of mind. Now I wish I had started this years ago. Thanks for your persistence.

Christina Duong - Hair Salon Owners

Cedar Park, TX

Running my salon is non-stop, My 14-year-old used to avoid chores and responsibilities. Now my 14-year-old designs our salon flyers, keeps our client list updated, and actually reminds me about deadlines. My 9-year-old folds towels, organizes products, She saw kids who take responsibility seriously, and it’s rubbing off on her.

Ha Thu Nguyen - Restaurant Owner

Austin, TX

Running a restaurant means my days are packed, and tax planning was never my strong suit. With Tax-Smart Paychecks, I learned how to legally hire my two teenage kids to help with social media, bookkeeping, and packaging takeout orders. The program guided me step-by-step, from setting up payroll to keeping perfect IRS-compliant records. Not only am I saving over $7,000 a year in taxes, but my kids are building real job skills and their own retirement savings. It’s a win for my business and my family

Unlock Your Family’s Full Financial Potential!

Whether you want to cut your taxes, set up savings & investments for your children, or turn your family business into a long-term wealth-building tool, we’ll guide you every step of the way.

Unlock Your Full Career Potential!

Whether you’re exploring new career paths, aiming for a promotion, or seeking career transitions, we are here to guide you every step of the way.

Phone Number

(832) 718-4711

Address

11425 Rustic Rock Dr Unit B, Austin Texas 78613

Company

Home

About Us

Blog

Contact Us

Help

Customer Support

Terms & Conditions

Privacy Policy

Follow Us